Letters of Credit in Export

Letters of Credit (LC) play a fundamental role in international trade, offering a secure payment mechanism that facilitates smooth transactions between exporters and importers.

In this comprehensive guide, CA on Web will navigate you into the world of Letters of Credit, explore their types, decode the complicated process involved, and shed light on their significance in export.

What is a Letter of Credit?

A Letter of Credit is a financial instrument issued by a bank on behalf of an importer (the buyer) to guarantee payment to an exporter (the seller) for the goods or services delivered. It acts as a commitment by the bank to make the payment upon the fulfilment of specified conditions.

Get in Touch

Types of Letters of Credit

1. Irrevocable LC

Letters of Credit that provides a higher level of security to the exporter by not getting cancelled or changed without the consent of all parties involved are called Irrevocable Letter of Credit.

2. Revocable LC

Unllike irrevocable LC, revocable LC can be altered or cancelled by the issuing bank without the consent of the exporter. This type is less common and offers less security.

3. Confirmed LC

In this type, another bank, usually in the exporter's country, adds its confirmation to the LC, ensuring that the payment will be made even if the issuing bank defaults.

4. Unconfirmed LC

It lacks the additional confirmation from a second bank, which makes it riskier for the exporter.

5. Transferable LC

Exporters can transfer their rights to receive payment to another party, allowing them to sell the goods to an intermediary.

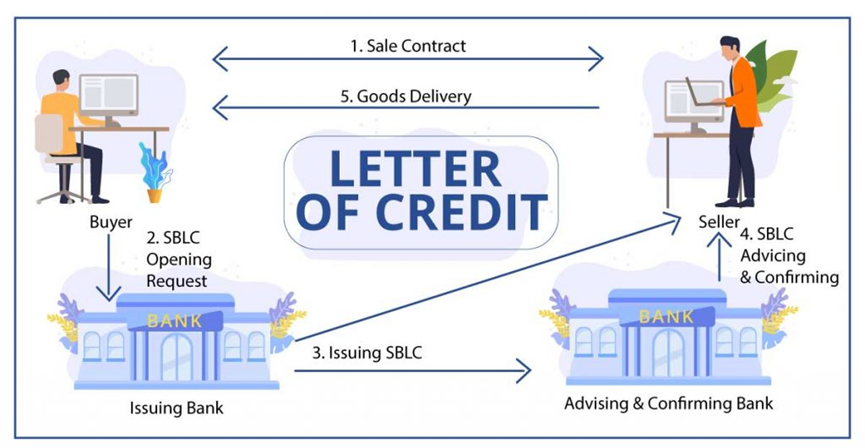

The Letter of Credit Process

Understanding the process is crucial for exporters and importers:

| 1 | Step 1: Agreement | The buyer and seller agree on the use of a Letter of Credit as the method of payment. |

| 2 | Step 2: Issuance | The buyer requests their bank to issue an LC in favor of the seller. |

| 3 | Step 3: Issuing Bank's Review | The issuing bank reviews the LC application, ensuring it complies with the terms and conditions. |

| 4 | Step 4: LC Transmission | LC is sent by the issuing bank to the advising bank in the country of the seller. |

| 5 | Step 5: Shipment | The exporter ships the goods and provides the necessary documents to the advising bank. |

| 6 | Step 6: Document Examination | The advising bank examines the documents for compliance with the LC's terms. |

| 7 | Step 7: Payment | Upon approval, the advising bank forwards the documents to the issuing bank, which then releases the payment to the exporter. |

Significance of Letter of Credit in Export

Letters of Credit offer numerous advantages, making them integral to international trade:

1-Risk Mitigation: Exporters are assured of payment upon compliance with the LC terms.

2-Market Expansion: Enables exporters to reach global markets with confidence.

3-Financial Security: Provides a financial guarantee, reducing payment risks.

4-Creditworthiness: Boosts the exporter's reputation as it demonstrates the buyer's trust.

Frequently Asked Questions

A letter of Credit is a contractual obligation by the importer’s bank to pay after the goods are shipped and required documents are presented by the exporter to its bank as proof. Letters of Credit are considered as a trade finance tool to guard both exporters and importers.

An unconfirmed LC means that the bank issuing it is only accountable for payment. Hence, revocable, and unconfirmed LCs are way cheaper and more flexible for buyers.

Commonly, irrevocable, and confirmed LCs are preferred for sellers to be more secure.

To avoid risk in the collection of payments from the importers in the foreign country the letter of credit is needed by the exporter to assure against the non-payment of dues by the importer.

Without giving prior notice or without consent of the beneficiary a revocable letter of credit can be cancelled or amended by the issuing bank at any time.

Expert Insight

According to industry expert CA Sanket Agarwal, "Letters of Credit are a lifeline for exporters. They provide much-needed assurance in international transactions, ensuring that their hard-earned revenues are protected. Choosing the right type of LC and understanding the process is paramount for success in export."

In conclusion, Letters of Credit are a keystone of international trade, ensuring secure and smooth transactions. Exporters, in collaboration with tax consultants like CAonWeb, should leverage this robust financial instrument to expand their global footprint and gain a competitive edge.

Need Help? Call Us 24/7

0120 - 4231116© Copyright CAONWEB All Rights Reserved